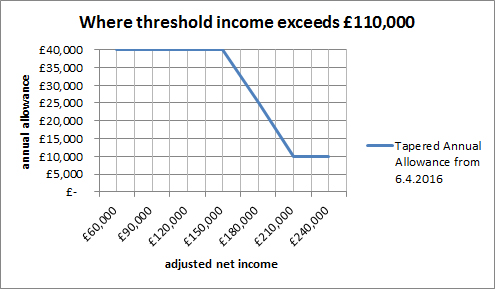

Following announcements in the July 2015 Budget, from 6th April 2016 there will be a tapering of the Annual Allowance for those with adjusted net income (including personal and employer contributions) of £150,000 or more. In these cases, the normal annual allowance will be reduced by £1 for each £2 of income above £150,000 subject to a maximum reduction of £30,000 for those earning £210,000 or more.

What this means in practice:

Firstly, in order to work out whether tapering applies you need to establish two values – “threshold income” and “adjusted net income”. It makes sense to start with threshold income:

This is the total amount of earned and investment income, and as such includes:

It excludes pension contributions, other that salary exchange arrangements put in place on or after 8th July 2015.

If the total of the above is less than £110,000 then the tapering of the annual allowance does not apply.

This is the same as threshold income (above) PLUS the gross value of personal contributions made under net pay schemes plus any employer contributions (whether by salary sacrifice or not).

If threshold income is above £110,000 and the value of adjusted net income exceeds £150,000 then then tapering of the annual allowance will apply at the rate of £1 reduction in the annual allowance for every £2 the adjusted net income exceeds £150,000. The amount of the reduction is rounded up to the nearest whole pound, and is subject to a maximum reduction of £30,000 (for those with adjusted net income of £210,000 or more).

Individuals in receipt of higher income should speak to their financial adviser and accountant to see whether they are affected by this. For some, it may not be obvious whether the limits will be exceeded until after the end of a tax year, making planning more challenging.

Carry forward is still available for those subject to the tapered annual allowance.

Tapering does not affect the Money Purchase Annual Allowance, but it will reduce the “alternative annual allowance” which can apply for individuals who have accessed some of their pension savings under the new flexible options and who are accruing benefits in a Defined Benefits scheme. The “alternative annual allowance” is normally £30,000 but can be reduced by tapering.

The tapering of the annual allowance is dealt with through your tax return, there is no need to tell us although customers should always discuss this with their financial adviser.

March 31st, 2016